Digital Innovation Can Break Barriers, Here’s Why Financial Inclusion Matters in Africa

Picture a bustling marketplace in Uganda, or rural communities across Africa, where everyday transactions are still largely cash-dependent and many people lack access to affordable financial services. For millions, this means that essential needs, like paying for medical care, trading goods, or securing a loan, are out of reach, not because of lack of effort, but because they are shut out of modern digital finance. The consequences of this digital divide are profound and persistent, impacting livelihoods, education, and health. The need to bridge this gap has never been greater, yet achieving true financial inclusion in Africa remains a complex challenge.

At the heart of this challenge lies the promise of digital transformation. When communities have access to convenient, secure, and interoperable payment systems, the possibilities multiply: economic growth, poverty reduction, and social empowerment. Initiatives focused on digital financial inclusion are not simply about adopting new technology, they are about changing lives, providing stability, and giving women, youth, and marginalized groups the tools they need to thrive. But without coordinated advocacy, research, and the right policy frameworks, such a vision risks stalling before it takes root. Understanding both the mechanics and the mission behind digital financial inclusion is critical for those who want to see Africa’s economies, and people, reach their full potential.

Unlocking the Power of Digital Financial Services in Africa’s Evolving Economy

Digital financial services (DFS) are transforming the way people in Africa access, save, and spend money. By enabling transactions through mobile money wallets, digital payment systems, and instant, inclusive payment networks, DFS break down traditional barriers that have long kept millions of Africans outside the financial mainstream. Tools like mobile bank accounts and interoperable payment infrastructures help individuals seamlessly manage their finances, receive income, and participate in local and cross-border trade. These innovations are at the core of Africa’s digital revolution, bringing opportunity to underserved communities who might otherwise remain marginalized.

Yet the journey toward widespread financial inclusion is riddled with obstacles: lack of awareness, limited infrastructure, fragmented ecosystems, and policy gaps. When people do not understand the advantages or cannot access secure digital platforms, they can remain entrapped in cycles of poverty, vulnerability to income shocks, and exclusion from vital services like healthcare, education, and agricultural advancement. This is especially true for women, persons with disabilities, and rural communities, who face greater hurdles in accessing financial tools. Only by understanding the systemic nature of financial exclusion can stakeholders and advocates mobilize effectively to ensure everyone participates in this evolving economy. For Africa, the stakes could not be higher, as digital finance becomes a critical lever for social transformation and sustainable development.

How Digital Inclusion Initiatives Are Improving Lives Across Africa

As an established contributor to the digital financial inclusion landscape, HiPipo Foundation offers insights into why such work has immediate, tangible benefits for communities. Facilitating the adoption of digital financial services is not just about pushing innovative products; it’s about opening doors for entire communities, especially the poor, women, youth, and other underserved groups, to gain access to the financial systems that power modern societies. With inclusive payment systems and support for digital financial literacy, more people now have the tools to save, invest, and withstand financial shocks, thus improving daily life and long-term stability.

Digital financial inclusion also accelerates access to healthcare, education, agricultural development, and leadership opportunities for marginalized groups. For example, initiatives that support women’s access to financial literacy and technology skills translate into greater control over their financial decisions, improved business prospects, and more robust participation in society. Programs like face-to-face fintech events and tailored training not only highlight the latest trends and technologies but also provide platforms for innovation. By connecting local entrepreneurs and artisans with digital tools, entire communities benefit through increased economic activity, greater resilience, and reduced gender and income disparities. The ripple effect of financial inclusion can transform households and communities, supporting Africa’s journey towards equitable sustainable development.

Promoting Gender Equality and Closing the Gap Through Digital Access

A defining feature of meaningful financial inclusion is closing persistent gender gaps in access and use of DFS. Empowering women through digital finance is central to the broader mission of social transformation: when women have access to secure digital financial services, like mobile money, digital bank accounts, and affordable payment options—they gain influence over both their personal and household economic destinies. Providing women and girls with digital and business skills, strengthening their voices in fintech, and ensuring equitable participation drives not only individual success but also strengthens entire societies.

Financial inclusion advocacy recognizes that women in Africa remain disproportionately unbanked, particularly in rural areas and the informal sector. Initiatives such as Women in FinTech Hackathons, summits, and tailored training are designed to champion technical and entrepreneurial capacities, empowering the next generation with skill sets to navigate and lead in the digital economy. By enabling youth, women, and special interest groups to contribute to and benefit from financial innovation, Africa stands to accelerate agricultural productivity, expand educational access, and make health and financial security an achievable reality for millions.

From Research to Impact: Advocacy That Shapes Policy and Practice

One of the unique strengths of leading digital inclusion organizations is their commitment to research-driven impact and advocacy. By regularly conducting financial inclusion studies, these groups assess the effectiveness and reach of innovative digital finance products. For instance, robust documentation on the time-saving capacity of mobile money was referenced in key industry reports, influencing not only product development but also regulatory discussions at the continental level. Such research ensures that public policy and private sector investment are grounded in real-world needs and outcomes.

Strategic events like the Digital and Financial Inclusion Summit, the Digital Impact Awards Africa, and region-wide fintech workshops bring together regulators, financial institutions, and innovators from across the continent. These forums foster collaboration, celebrate success, and spotlight trends likely to transform the financial services sector. By prioritizing both excellence and inclusivity, these events guarantee that progress is informed by evidence, is widely accessible, and ultimately benefits those who need it most. Collaboration between global agencies, governments, innovators, and community groups ensures that momentum for financial and digital inclusion remains strong and rooted in local realities.

Why Stay Informed Matters: The Digital Advantage for Households and Communities

For individuals and families living in vulnerable circumstances, knowledge about digital financial services can be life-changing. When everyday people understand how to use mobile wallets, save digitally, access loans, or participate in secure crowdfunding platforms, they circumvent many traditional barriers to prosperity. This awareness empowers informed choices, protects consumers from fraud, and lays the groundwork for financial stability in times of personal or community crisis.

Maintaining an up-to-date understanding of available digital options helps households manage savings, weather income shocks, and access essential services when they need them most. Comprehensive digital literacy—spread through workshops, hackathons, and public challenges, invites broad participation and gives a voice to the needs and aspirations of users. The result is a cycle of empowerment, as educated participants advocate for improvements and share their gains with their wider communities. For Africa’s fast-growing economies, there is a clear imperative: those best equipped with digital knowledge gain the steepest advantage in the rapidly changing landscape of opportunity.

HiPipo Foundation’s Vision: Empowerment, Collaboration, and Lasting Impact

A core tenet of HiPipo Foundation’s philosophy is the belief that every African should equitably participate in and benefit from the continent’s digital dividend. By focusing on digital finance, inclusive payment systems, and the needs of low-income users, the Foundation strives to maximize both reach and resilience within vulnerable populations. Its approach is built on identifying and nurturing digital innovation, not only through technology but by building bridges between regulators, innovators, financial institutions, and local communities. This collaborative ethos ensures that solutions are both practical and representative.

HiPipo Foundation’s mission embodies social transformation, using research, training, and events to drive awareness and adoption of secure, affordable, and interoperable digital finance solutions. By placing special emphasis on women, youth, and marginalized communities, the Foundation’s programs help unlock opportunity for all, and in turn, trigger the empowerment that leads to poverty reduction, improved livelihoods, and sustainable development. The commitment to leveling the playing field, through evidence-based advocacy, education, and platforms celebrating innovation, demonstrates the pivotal role that expert organizations can play in guiding Africa’s journey to digital financial inclusion.

Furthermore, by embedding the “Include Everyone” philosophy at its core, the Foundation champions projects designed to foster digital literacy, encourage innovation among local artisans and traders, and provide the scaffolding for policies that protect and uplift the most vulnerable. Their vision is ambitious: to see affordable digital financial services become the backbone for improved health, education, and economic agency for all Africans, especially women and youth.

Validated Success: Real Experiences Transforming Communities

The impact of digital financial inclusion is most tangible when seen through the stories of the individuals and groups it serves. First-person accounts and community feedback consistently reinforce how financial innovation changes lives and brings hope to those who need it most.

When people experience the empowerment that comes with access to digital financial services and platforms, whether through learning, accessing new markets, or gaining the confidence to manage their own finances, the benefits ripple outward. Participating in training workshops, hackathons, or awareness events leads to skills acquisition, broader community involvement, and a sense of inclusion that goes beyond simple transactions. Those who take their first step onto the digital financial landscape often find themselves not only more secure, but more hopeful about the future. For communities across Africa, these successes validate the ongoing need for advocacy, education, and accessible financial solutions.

What Inclusive Digital Finance Means for Africa’s Future

Africa stands at the threshold of a digital financial transformation that promises to reshape economies and empower citizens on an unprecedented scale. Digital financial inclusion, fueled by payment system innovation, targeted advocacy, and multi-stakeholder collaboration—brings opportunities not just for efficiency, but for true equity and development. As research, events, and community initiatives highlight, the foundations built today are laying the groundwork for widespread prosperity, gender parity, and lasting resilience.

The HiPipo Foundation’s leadership in championing equitable, instant, and secure payment systems demonstrates what can be achieved when technical innovation goes hand-in-hand with a vision for social good. Their continued contributions point the way for others looking to close inclusion gaps and inspire a continent to fully realize its digital potential. In embracing digital financial inclusion now, Africa is setting the stage for generations of progress and opportunity.

Contact the Experts at HiPipo Foundation

If you’d like to learn more about how digital financial inclusion could benefit your community or organization, contact the team at HiPipo Foundation.

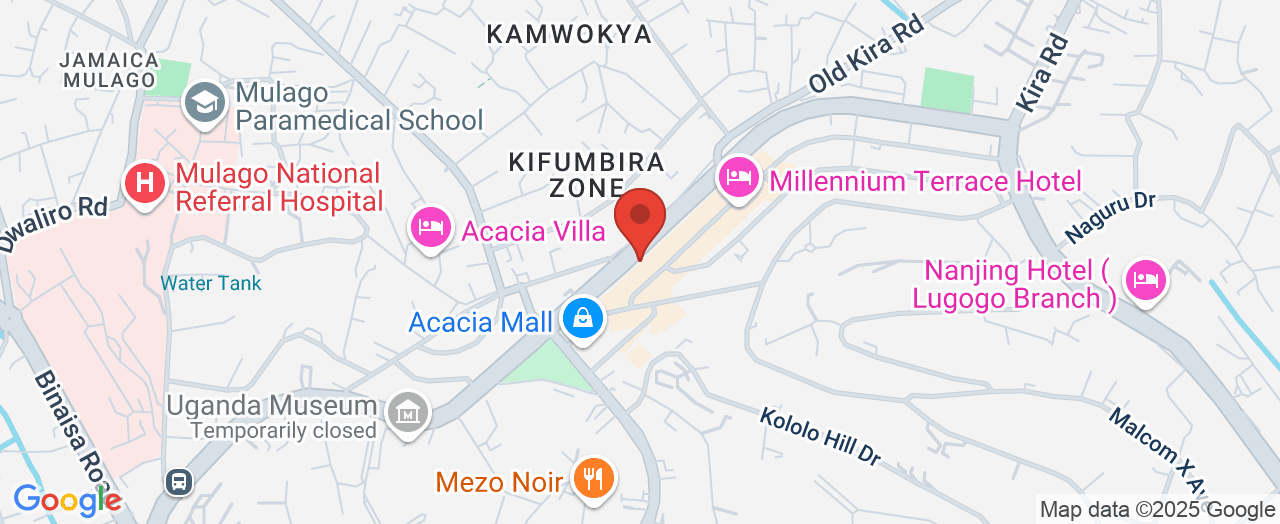

📍 Address: HiPipo Towers, Plot 33 Kira Rd, Kampala, Uganda

📞 Phone: +256779345331

🌐 Website: http://hipipo.org/

HiPipo Foundation Location and Hours

Add Row

Add Row  Add

Add

Write A Comment