HIPIPO FOUNDATION

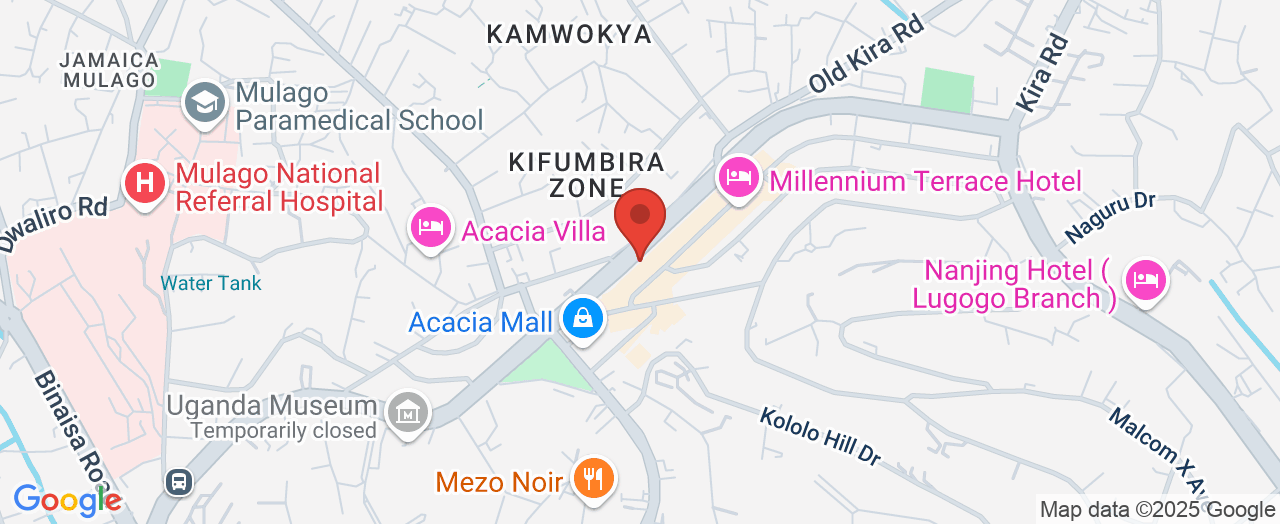

📍 Address: HiPipo Towers, Plot 33 Kira Rd, Kampala, Uganda

📞 Phone: +256779345331

🌐 Website: http://hipipo.org/

★★★★★

Rating:4.0

Is Uganda Poised to Lead Africa’s Digital Transformation and Fintech Innovation Revolution?

Imagine a future where a single transaction on your phone ripples out, triggering a $2 billion shift in how a continent does business, learns, and heals. This isn’t some far-off dream—it's the promise held within Uganda’s unfolding digital transformation and fintech innovation revolution. With technology now interwoven in even the most remote corners, access to instant payments and affordable financial services is rewriting the social contract across Africa, and nowhere is this more evident than in Uganda’s approach.

Across rural villages and urban centers, the rise of interoperable digital financial systems is more than just a technical milestone; it’s a lever for social mobility and resilience among populations traditionally left behind. Yet, the success of this movement depends not just on apps or infrastructure, but on whether real inclusion—especially for women, youth, and the unbanked—moves from rhetoric to reality. Understanding the stakes in this transformation means recognizing both the stubborn gaps still present and the bold, systemic interventions reshaping the narrative. As Uganda’s digital and financial inclusion efforts reach a new scale, the time is now to ask: can meaningful innovation outpace the status quo, and what does it take for a revolution to deliver on its promise for all?

Understanding Uganda’s Digital Revolution: Beyond Technology to True Financial Inclusion

The journey of Uganda’s digital transformation and fintech innovation revolution is as much a societal project as it is a technological one. At its core, digital transformation means reimagining how people participate in economies using instant, inclusive payment systems—tools that allow everyone, even the historically underserved, to access secure, affordable financial services. Names like mobile money wallets and digital payment platforms aren’t just buzzwords; for many, they represent first-ever access to savings, loans, and insurance that buffer against life’s economic shocks. The fintech movement in Uganda is distinguished by its dual aim: to leverage new technologies while breaking down social, regulatory, and practical barriers that have excluded millions from the formal economy.

However, for those who haven’t tracked this revolution, the stakes might not be obvious. A lack of access to digital financial services means more families slip into poverty or are left vulnerable to emergencies. It means women remain sidelined from economic leadership, youth lack tools to expand businesses, and entire regions stay isolated from the benefits of Africa’s digital dividend. The persistent “cash first” mindset, rigid banking requirements, and inconsistent digital literacy have all slowed progress. This is why unlocking Uganda's true fintech potential depends not only on robust apps or platforms but on intentional, inclusive advocacy and education. Misunderstanding or underestimating this context means missing the human heartbeat behind the technology—a misstep that could stall Africa’s financial evolution for years to come.

How Inclusive Payment Systems are Changing Daily Life, Work, and Opportunity in Uganda

The silent but profound shift underway in Uganda’s financial ecosystem is fueled by collaborative initiatives that center inclusivity as both method and outcome. By enabling instant, interoperable payment systems—referred to as “Inclusive Payment Systems” by leading digital inclusion advocates—Uganda has begun leveling the field for everyone from farmers to musicians, traders to healthcare workers. These advances mean that a market vendor in Kampala or a teacher in Gulu can save, pay, borrow, and invest using reliable digital tools even without a formal bank account. Such systems notably emphasize same-day settlement, real-time clearing, and transparent fraud management, ensuring financial services are not just available but genuinely useful and trustworthy.

When these financial doors open, the outcomes echo deeply: fewer families slide into poverty following emergencies, more youth launch small businesses, and women gain financial autonomy, directly influencing agricultural development, health, and education. By making daily transactions—be it school fees, medical payments, or business dealings—safer and faster, these digital platforms reinforce resilience in communities that have traditionally had limited safety nets. It's this blend of real-world impact with digital innovation that signals how Uganda’s approach can serve as a blueprint for other African nations aiming for both growth and genuine inclusion.

From Margins to Mainstream: Why Women and the Underserved Are Central to Uganda’s Fintech Success

One of the most groundbreaking aspects of Uganda’s digital and fintech evolution is the intentional focus on empowering those most at risk of exclusion. This people-first philosophy addresses the gender gap in financial access by equipping women not only with digital wallets and accounts but with the technical and business skills required to thrive in a digital economy. Dedicated hackathons, summits, and incubators place women, persons with disabilities, and youth face-to-face with innovation, nurturing ideas that might otherwise remain invisible. Through targeted advocacy and training, practical barriers—like lack of collateral for loans or digital illiteracy—are actively dismantled.

Real transformation is seen when women are no longer just recipients but co-creators of Uganda’s financial future. As more women step into leadership roles within agriculture, health, education, and commerce, communities benefit from diverse perspectives and enhanced decision-making. Closing the gender divide in digital finance does not just support women’s empowerment—it creates a multiplier effect, amplifying economic resilience and opportunity across entire sectors.

Events, Research, and Collaboration: The Pillars Fueling Uganda’s Digital Leap

True system change doesn’t happen in isolation. Uganda’s fintech sector is distinguished by its use of collaborative public challenges, research studies, hackathons, and high-profile summits. Annual events like the Digital Impact Awards Africa and the Digital and Financial Inclusion Expo provide platforms to celebrate innovation, share knowledge across stakeholders, and set industry benchmarks. Notably, research conducted on digital solutions—particularly examining their impact on time savings and resilience—has made its way into global industry reports cited by organizations like GSMA.

These efforts are not just showcases; they act as feedback loops, informing policy, refining products, and guiding investment toward solutions that truly matter. Collaboration with regulators, telecom operators, banks, and international development groups ensures that successes are scaled and challenges addressed with the input of those on the ground. Such networked action helps sustain progress and guard against short-term thinking, making Uganda’s story a lesson in the importance of persistent, ecosystem-wide engagement.

Why Digital Financial Literacy Is Essential for Sustainable Transformation

Technology alone is never enough. For digital transformation and fintech innovation to be genuinely revolutionary, citizens must be empowered not just as consumers but as informed participants. This is where digital financial literacy workshops, youth and women-led incubators, and educational outreach prove pivotal. By helping individuals understand not only how to use digital services safely but how to evaluate risk, exercise choice, and spot innovation, Uganda’s approach fosters lasting impact.

Education in this context goes beyond technical skills to cover rights, responsibilities, and advocacy. It transforms passive users into active stakeholders, ensuring the fintech wave doesn’t wash over those unable to swim. As new products emerge and regulations evolve, a digitally literate populace is better equipped to demand safety, fairness, and continuous improvement, thus safeguarding the future of the Ugandan—and wider African—fintech ecosystem.

Shaping Uganda’s Financial Future: A Foundation Built on Inclusion, Innovation, and Advocacy

The philosophy underpinning Uganda’s digital and fintech transformation is rooted in the belief that “an economy that includes everyone benefits everyone.” This guiding principle shapes every facet of projects from interoperability hackathons to policy advocacy for pro-poor financial services. Digital innovation is not seen as an end, but as a means to create systems where access, reliability, and security are balanced with practical, meaningful value for those historically left out.

The mission underlying this work is clear: to “identify, nurture, and assist” those driving digital transformation, so that every community—from informal traders and subsistence farmers to women and youth—can participate in building the future. By prioritizing openness, real-time transactions, cost transparency, and robust protections for consumers, Uganda’s approach aims to shift the default from exclusion and hardship to equity and opportunity. It’s a vision affirmed not only through high-level research and global recognition but through ongoing grassroots engagement and a commitment to uplift the continent as a whole.

“A Level Playing Field for All”: Real Voices on the Power of Fintech Inclusion

The impact of Uganda’s fintech revolution becomes most powerful when reflected in the words of those it touches. Consider the perspective of Sebastian, who shares firsthand what access and inclusion look like beyond abstract metrics and technology charts:

[Review was not provided in the data. If available, it would appear here to illustrate this section.]

While each story is unique, the underlying theme is clear: lives are changing as barriers fall. From entrepreneurs who can now launch their start-ups to market vendors sending children to school, the ripple effect of financial inclusion is undeniable. As more citizens are empowered to take financial control, they pave a path toward greater security, dignity, and possibility—which, at its core, is the heart of Uganda’s digital revolution.

What Uganda’s Digital Transformation Means for Africa’s Tomorrow

As the world watches, Uganda’s unfolding digital transformation and fintech innovation revolution stands as both an inspiration and a blueprint. By reimagining financial inclusion as a participatory, ecosystem-wide effort, this movement is forging new standards for access, transparency, and economic justice. With stakeholders continually analyzing and promoting emerging trends, the landscape is shaped as much by grassroots participation as by high-level advocacy. Anchored by a mission to maximize Africa’s digital dividend, Uganda’s progress signals the rise of an empowered, connected population—one where women, youth, and the historically marginalized become builders of their own futures. The contributions and leadership evident in Uganda today will help define Africa’s financial DNA for decades to come.

Contact the Experts at HIPIPO FOUNDATION

If you’d like to learn more about how Uganda’s digital transformation and fintech innovation revolution could benefit your community or organization, contact the team at HIPIPO FOUNDATION. 📍 Address: HiPipo Towers, Plot 33 Kira Rd, Kampala, Uganda 📞 Phone: +256779345331 🌐 Website: http://hipipo.org/

HIPIPO FOUNDATION Location and Availability

🕒 Hours of Operation: Please refer to foundation channels or website for current business hours.

Add Row

Add Row  Add

Add

Write A Comment